Aquin Advises:

On The Sale To:

Key Terms

| > | Effective January 17, 2025, Uhlmann Group (»Uhlmann«) announced the acquisition of Goldfuß engineering GmbH (»Goldfuß«) from Thomas Goldfuß, managing director and founder of Goldfuß. |

| > | Aquin acted as the sole M&A advisor to the former owner of Goldfuß. |

Strategic Logic

| > | With the acquisition of Goldfuß, the Uhlmann Group aims to expand its role as a provider of holistic packaging solutions. Goldfuß leverages its robotics and automation know-how to address two future-oriented fields that are in high demand within the Uhlmann Group’s customer base. |

| > | For Goldfuß, with its decades of experience, the acquisition is a future-oriented and growth-oriented step. Uhlmann, as a family-owned company, shares similar values and believes in the continued successful development of Goldfuß. |

GOLDFUß

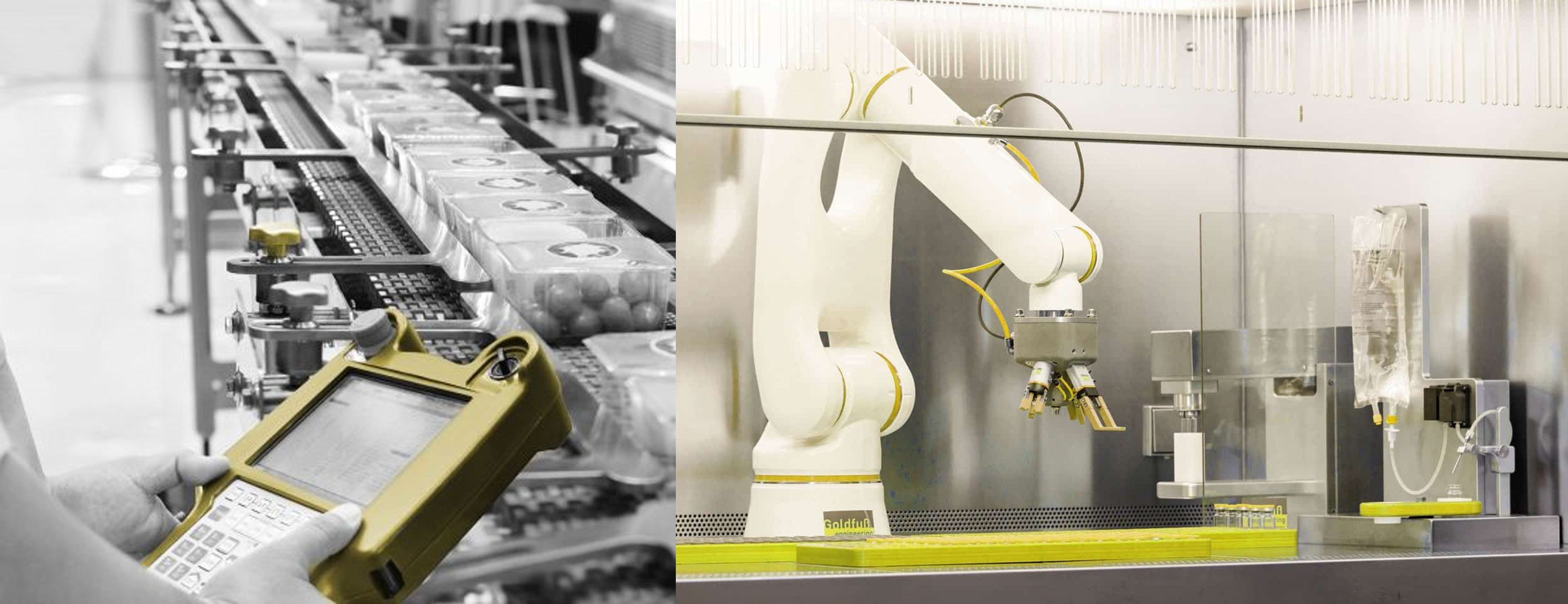

| > | Goldfuß develops, designs, and manufactures systems in the fields of packaging technology, laboratory automation, and custom machine construction for the pharmaceutical, medicine, personal care, food, and crop science industries. |

| > | The company delivered 170+ systems and is active in 13 countries. |

| > | Founded in 1996 and headquartered in Balingen (GER), Goldfuß currently employs 45 people. |

UHLMANN

| > | Uhlmann offers a broad range of high-tech packaging machines, services, and digital solutions for the pharmaceutical, healthcare, consumer goods, food, and agricultural markets. |

| > | Starting in Laupheim (GER) in 1948 as a mechanical engineering company for the pharmaceutical market, the members of the Uhlmann Group are now present worldwide at 18 locations in 14 countries. |

| > | Established in 2019, the holding generates around 462 MEUR in revenues with 2,600 employees. |