Aquin Advises:

On The Acquisition Of:

Key Terms

| > | With effect from January 14, 2016, Ambienta acquired the Mikrotron GmbH, one of the leading providers of high-speed cameras for industrial image processing. |

| > | Aquin acted as the exclusive M&A advisor to Ambienta. |

Strategic Logic

| > | This transaction is part of Ambienta‘s strategy to establish itself as one of the leading European suppliers for industrial image processing (LakeSight). |

| > | The cornerstone of the project LakeSight was laid in 2012 with the acquisition of Tattile, a supplier of industrial machine vision solutions from northern Italy. The acquisition of Mikrotron represents another important step towards becoming a provider of image-processing systems at a global scale. |

| > | In the medium term, and as a result of the consolidation of smaller but innovative companies, LakeSight should be able to achieve an annual turnover of about 50 million euros with the global export of innovative high-quality products. |

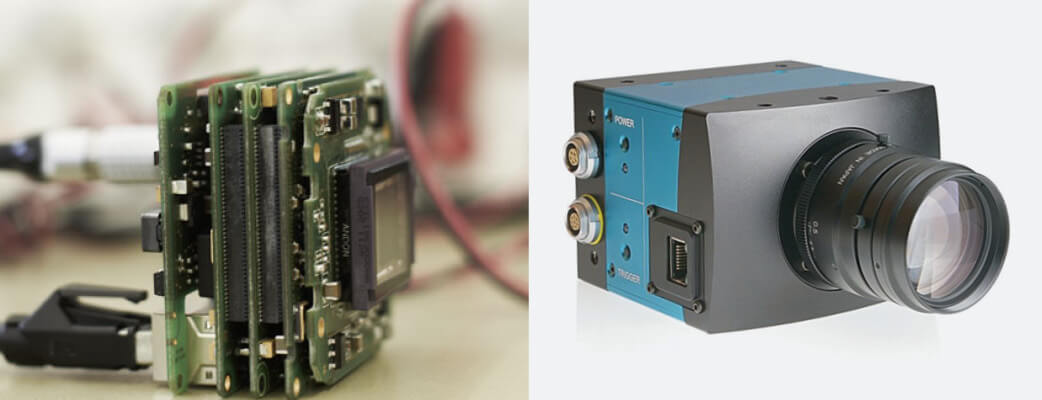

| > | Mikrotron GmbH, founded in 1976, ranks among the leading manufacturers of high-speed cameras and recording systems for various applications in many different industries. |

| > | The company offers a wide range of products and has an extensive network of major customers, who are serviced through consistently expanded international distribution channels. |

| > | Mikrotron employs about 35 people and has an annual turnover of about 10 million euros. |

| > | Ambienta is a leading European private equity fund located in Milan, Düsseldorf and London. |

| > | Ambienta invests in businesses with a strategic focus on resource and energy efficiency as well as the reduction and prevention of environmental pollution. |

| > | With an equity capital of more than 500 million euros, Ambienta has already invested in 18 companies in the field of environmental engineering. |