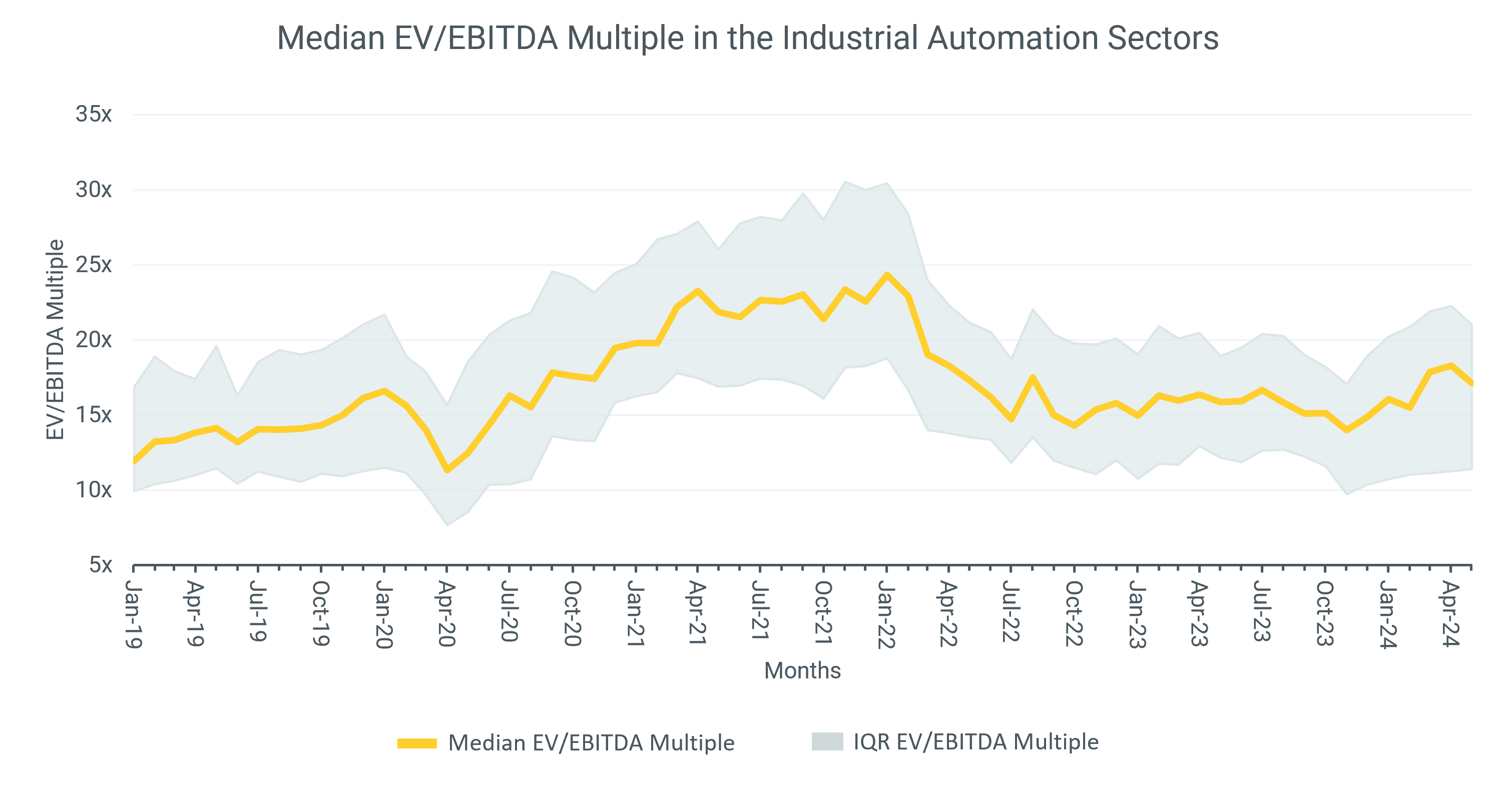

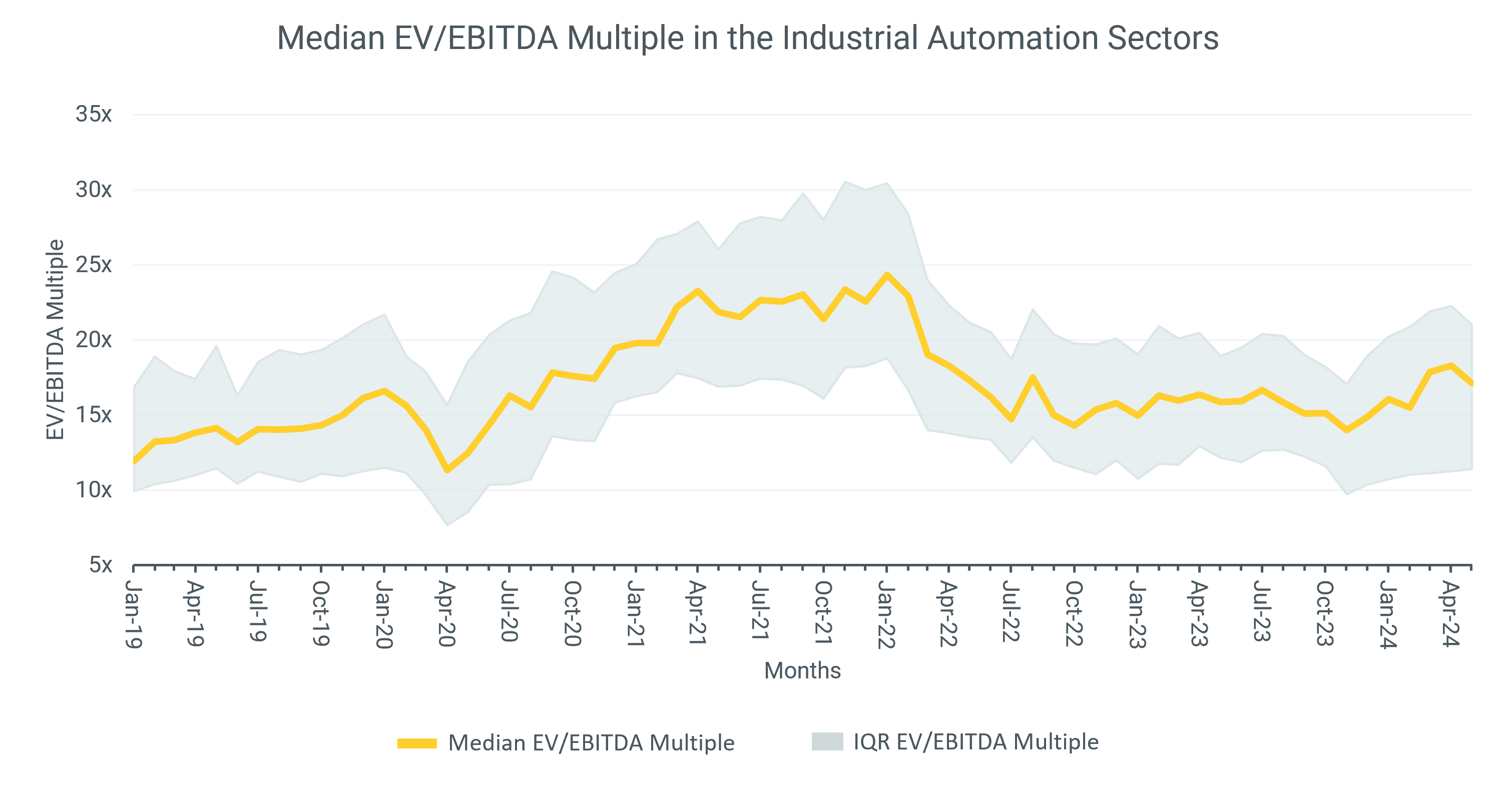

EV/EBITDA Multiple Development.

November 30, 2022

The chart visualizes the development of the median EV/EBITDA multiple of listed companies in the industrial automation sector. It also shows the interquartile range (IQR), which comprises 50% of all EV/EBITDA multiples observed. It can be seen that the median multiple has stabilized at a level above the initial level of 2020 despite ongoing uncertainties after the peak of the corona pandemic. This indicates continued confidence in the future performance of the industry.

Constituents: (i) Components: Gefran S.p.A., Renishaw plc, Spectris plc, TT Electronics plc, TE Connectivity Ltd., ams-OSRAM AG, Interroll Holding AG, Komax Holding AG, Sensirion Holding AG, Infineon Technologies AG, Jenoptik AG, INFICON Holding AG, Analog Devices, Inc., Ambarella, Inc., Coherent, Inc., Novanta Inc., Amphenol Corporation, Belden Inc., CTS Corporation, Rockwell Automation, Inc., Regal Rexnord Corporation, Silicon Laboratories Inc.; (ii) Plant Construction: Atlas Copco AB, Hexagon AB, Bystronic AG, Kardex Holding AG, Mikron Holding AG, Aumann AG, Dürr AG, KION GROUP AG, MAX Automation SE, ATS Automation Tooling Systems Inc.; (iii) OEMs: KUKA AG, Teradyne, Inc., Lincoln Electric Holdings, Inc., Cognex Corporation, FARO Technologies, Inc., Keysight Technologies, Inc.; (iv) All in One: Schneider Electric S.E., ABB Ltd, Siemens AG, Eaton Corporation plc, Emerson Electric Co., Fortive Corporation, Roper Technologies, Inc.

Quelle: Aquin Research, Capital IQ

Share This Story, Choose Your Platform!